债市震荡的后果很严重,投资者该如何应对?

|

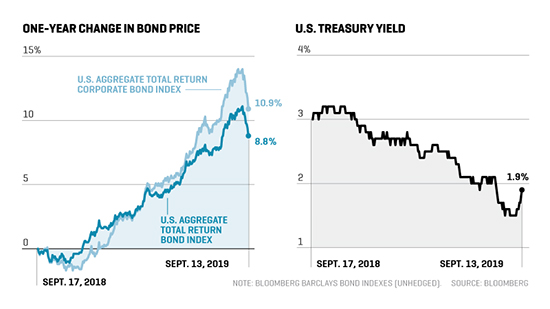

对紧张不安的投资者来说,几十年来债券一直是不明朗局势中的“辐射避难所”。但在2019年,债券市场看起来却更像是瞄准投资者投资仓位的导弹。 大衰退至今的10年中,世界各国利率在大多数时间里已经处于低点,如今则再次下降,这让养老基金和小规模投资者更难获得缓慢但稳定的利率收益,而正是这种收益让债券成为许多退休基金的源泉。造成这种局面的因素有几个,包括持续了10年的经济扩张开始放缓、中美贸易争端可能给全球贸易带来压力以及多数经济学家都认为2021年以前将出现衰退。 所有这些因素都很重要,原因是它们压低了利率,而投资者也变得更愿意接受较低的“收益率”,或者说利率,以换取债券在他们眼中的安全性。在这些因素的共同影响下,作为基准的美国10年期国债收益率已经从2018年11月的3.24%降至今年9月1.45%的低点。 收益率下降会形成上升空间,至少理论上是这样。收益率降的越低,现有债券的价格就涨的越高,从而使它们较高的利率显得更有吸引力。从今年年初到9月中旬,彭博巴克莱美国综合债券指数上升了8%,一只美国公司债券指数也上扬了12.3%。不过,几乎没有债券投资者希望利率重新回到零,原因是微薄收益率的影响将超过任何债券价格的上涨。 债券投资巨头太平洋投资管理公司掌握着1.8万亿美元资产。该公司的董事总经理斯科特·马瑟说:“今后,回报率将低于此前10年的水平,而这会给投资者带来挑战。” |

For decades, bonds have offered a kind of fallout shelter for jittery investors in uncertain times. But in 2019, the bond market has looked more like the tip of a warhead aimed at their portfolios. Global interest rates, already low for most of the decade since the Great Recession, are falling again, making it harder for pension funds and small investors to harvest the slow-and-steady interest income that makes bonds the foundation of many retirement funds. There are a number of factors at play: A decade-long economic expansion is starting to lose its momentum. The U.S.-China trade war threatens to weigh down global commerce. And a majority of economists expect a recession by 2021. Here’s why that all matters: These factors drive down rates, as investors become more willing to accept less “yield,” or interest, in return for bonds’ perceived safety. Taken together, these forces have dragged the rate on the benchmark 10-year U.S. Treasury from 3.24% in November 2018 to as low as 1.45% this September. Falling rates have an upside, at least on paper: The further they fall, the higher prices rise on existing bonds, whose higher rates look more attractive. The Bloomberg Barclays U.S. Aggregate Bond Index is up 8% this year through mid-September, while an index of U.S. corporate bonds is up 12.3%. Still, few bond investors relish going back to near-zero interest rates because meager yields will outweigh any price gains. “Going forward, the returns are going to be lower than they have been in the last decade,” says Scott Mather, a managing director at bond-investing giant Pimco, which has $1.8 trillion in assets under management. “And that makes it challenging for investors.” |

|

这种环境下债券投资者能做些什么呢?低收益率和经济趋弱让可接受的方案变得很少。鉴于债券价格处于高位,现在或许是卖掉高收益债券等风险较高证券的恰当时机,这些证券在熊市中的震荡往往较为剧烈,和成长型科技股并无不同。 对就要或者已经退休的投资者来说,最安全的做法也许是紧握美国国债、质量较高的抵押贷款支持债券以及金融等基本面强劲的行业中的投资级公司债券。当然,这些债券的收益率或许很低,但其他资产的最终表现可能远不如它们。马瑟指出,美联储可能会把利率降到接近零的水平,甚至像诸多欧洲国家和日本那样进入更危险的负利率区间,尽管这“非常不可能”。这种情况有可能在一段时间内让现金成为吸引力较低的投资,就像上次衰退时那样。 退休前还有几十年时间存钱的投资者可以多冒些险,通过波动较大的投资对熊市加以利用。换句话说就是,如果属于这个群体,那么现在也许并不是把大量资金从股市转移到债市的时候。毕竟时间会证明,过于努力地去捕捉市场高点和低点还不如较稳定的买入并持有。但现在同样不宜通过囤积高风险、高收益的垃圾级债券来追逐较高的回报率。 马瑟说:“看到自己的投资收益率较低时,人们就会自然而然地想到‘也许我应该配置更多的高收益资产’。这是一个错误的决定,因为这样做可能比较危险。”(财富中文网) 本文另一版本登载于《财富》杂志2019年10月刊,标题为《债券买家陷入困境》。

译者:Charlie 审校:夏林 |

What can bond investors do in such an environment? The confluence of low yields and a weakening economy leaves few palatable options. With bond prices high, now could be an opportune time to sell off riskier securities, such as higher-yield bonds, which¬—not unlike growth-oriented tech stocks—tend to be more volatile in bear markets. For investors near or in retirement, the safest approach may be to hunker down in U.S. Treasuries, higher-quality mortgage-backed bonds, and investment-grade corporate bonds in sectors with strong fundamentals, such as financials. Their yields may be low, sure, but other assets could end up performing far worse. Mather says the Fed could cut U.S. interest rates to near zero, even if it’s “highly unlikely” it would veer into the risky terrain of negative interest rates, which have become commonplace in Europe and Japan. That’s likely to leave cash a relatively unattractive investment for a while, just as it was during the last recession. Investors who still have decades to save for retirement can stomach more risk and ride out bear markets in more volatile investments. Put another way: If you’re in this category, now’s probably not the time to move a lot of money from stocks into bonds. Trying too hard to time market highs and lows, after all, is a time-proven way to under¬perform a steadier buy-and-hold approach. But now’s also no time to chase higher returns by loading up on higher-risk, higher-yield junk bonds. “The natural inclination people have when they see lower yields in their portfolio is to think, ‘Maybe I should allocate more to high yield,’ ” Mather says. “That’s the wrong decision because it can be more dangerous.” A version of this article appears in the October 2019 issue of Fortune with the headline “Bonds Put Buyers in a Bind.” |